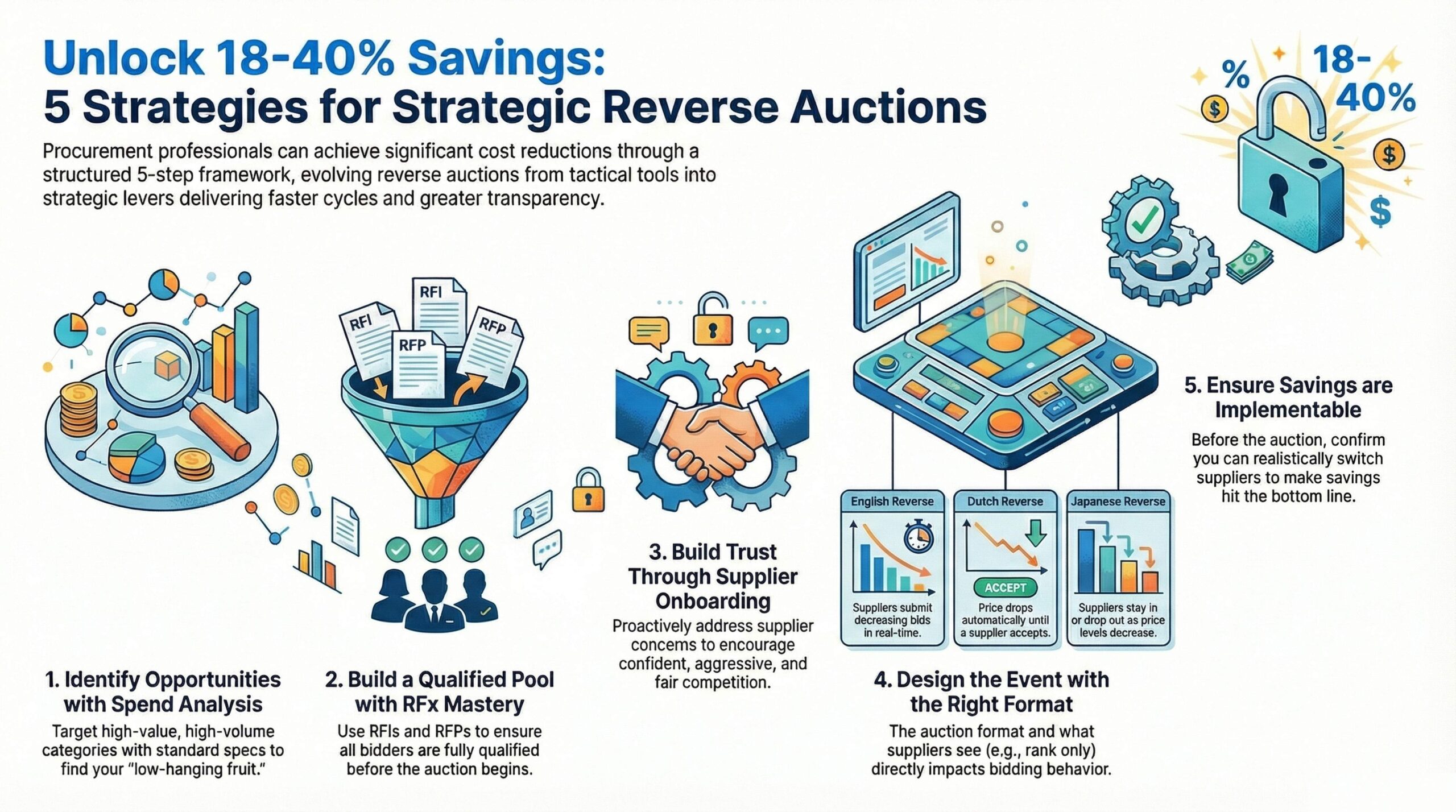

eSourcing auctions have evolved from tactical tools to strategic levers for procurement transformation. Organizations using them effectively—often through integrated eSourcing platforms—report savings between 18–40%, along with faster cycle times, higher compliance, and greater transparency.

Key Takeaways: Your 5 Strategies

| Strategy | Value Delivered |

|---|---|

| 1. Right Reverse Auction Format | Optimized competitive dynamics and price discovery |

| 2. Supplier Onboarding | Trust, confidence, and aggressive bidding |

| 3. Spend Analysis | Smarter category selection, low-hanging fruit |

| 4. RFx Mastery | Qualified suppliers, clear requirements |

| 5. Implementable Savings | Real savings that hit the bottom line |

1 Choose the Right Reverse Auction Format

Reverse auctions are powerful, but the format you choose determines how effective they’ll be. Not all reverse auctions work the same way—different formats create different competitive dynamics.

Common Reverse Auction Formats

- English Reverse: Suppliers submit decreasing bids in real-time, seeing all bid activity as it happens

- Dutch Reverse: Price increases at set increments & intervals until a supplier accepts

- Japanese Reverse: Suppliers commit to each price levels and drop out when they can’t commit any further

- Transformation Auctions: Supplier bids are transformed to compare prices from dissimilar suppliers

What Suppliers See Matters

The information you reveal during the auction changes supplier behavior:

- Full transparency (seeing all bids and rankings) drives aggressive competition but may intimidate smaller suppliers

- Rank only (showing position without prices) keeps suppliers engaged without revealing too much

- Best bid indicator (showing if they’re winning) creates urgency without full disclosure

How to Decide

Choose your format based on:

- Category type: Commodities benefit from full transparency; technical items may need transformation formats to normalize different specifications

- Pre-bid spread: Large price differences suggest using rank-only to prevent early dropouts; tight clustering works well with full transparency

- Supplier relationships: Strategic suppliers may respond better to formats that feel less aggressive

A well-chosen format ensures genuine price discovery while keeping qualified suppliers in the game.

2 Onboard Suppliers and Address Their Concerns Proactively

Suppliers appreciate the transparency that auctions provide, but they often have concerns about the format. These concerns need to be addressed proactively so suppliers trust the system and participate confidently.

Why Onboarding Matters

When suppliers understand how the auction works and feel their questions have been answered, they’re more likely to:

- Submit competitive bids instead of inflating prices due to uncertainty

- Stay engaged throughout the entire auction event

- View the process as fair rather than risky

Common Supplier Concerns

- How will my bid be evaluated? Clarify the scoring methodology and award criteria upfront

- What information will competitors see? Explain visibility settings (rank, best bid, full transparency)

- Is the auction just for price discovery? Be transparent about whether you’re committed to awarding through the auction

- What happens if technical specs are unclear? Provide opportunities to ask questions before bidding begins

Practical Approaches

- Conduct pre-bid meetings and Q&A sessions to walk suppliers through the process

- Share clear documentation including historical volumes, technical drawings, and terms

- Offer system training so suppliers feel comfortable with the eSourcing platform

- Be responsive to questions in the days leading up to the event

When suppliers trust the system, they compete more aggressively. Proactive supplier onboarding turns uncertainty into confidence—and that translates directly into better pricing.

3 Leverage Spend Analysis to Identify the Right Categories for Cost Reduction

Not all categories are equally suited for auctions. The key to maximizing savings is prioritizing categories where auctions will deliver the biggest impact—your low-hanging fruit.

Prioritize Categories That Are:

- High-value and high-volume – Where even small percentage savings translate to significant dollars

- Fragmented across multiple suppliers – Consolidation creates volume leverage and stronger negotiating position

- Non-critical with standard specifications – Where price competition can thrive without compromising quality or service

- Subject to favorable market conditions – Monitoring price trends and supplier availability helps you time auctions when conditions are in your favor

Focus on Low-Hanging Fruit

By using spend analysis to identify these characteristics, you ensure your auction efforts target categories with the highest probability of success. This approach allows you to:

- Demonstrate quick wins that build stakeholder confidence

- Allocate resources to auctions that will deliver measurable ROI

- Avoid wasting time on categories where auctions won’t work well

With AI-driven procurement analytics, procurement teams can even predict category volatility and plan auctions proactively when market conditions are most favorable.

Start with the categories that check the most boxes—that’s where your savings will come from.

4 Master RFx to Build a Qualified Competitive Supplier Pool

A successful auction starts long before the bidding begins. The RFx process ensures two critical outcomes:

- All participating suppliers are qualified and capable of delivery – No surprises after the award

- Technical specs, drawings, payment terms, and award criteria are crystal clear – Zero ambiguity means no post-auction renegotiation

RFx Framework

- RFI (Request for Information): Understand supplier capabilities, credentials, and capacity before inviting them to bid

- RFP (Request for Proposal): Evaluate technical fit, commercial terms, and alignment with your requirements

- RFQ (Request for Quotation): Gather standardized pricing that becomes your auction baseline

Best Practices

- Use scoring templates to evaluate supplier capability objectively and consistently

- Standardize RFx formats across events to reduce effort and ensure nothing is missed

- Only move technically-approved suppliers into auctions – If they can’t meet your requirements, don’t let them bid

- Clarify award criteria upfront so suppliers know exactly how they’ll be evaluated beyond price

- Provide complete technical documentation including drawings, specifications, and scope of work

Why This Matters

When you enter an auction with a qualified pool and clear requirements, you eliminate the two biggest risks: awarding to an incapable supplier or facing pushback on unclear terms. The auction becomes a pure price competition among qualified bidders—exactly what it should be.

5 Ensure That Savings Identified Are Achieved and Hit the Bottom Line

This is one of the most critical—and most overlooked—aspects of auction strategy. Identifying savings means nothing if you can’t actually implement them.

Choose Categories Where You Can Actually Switch Suppliers

Before running an auction, ask yourself: can we realistically award to a new supplier if they win? If the answer is anything other than a clear “yes,” reconsider the category.

Red Flags That Limit Savings Realization:

- High switching costs – Tooling changes, requalification, or system integration costs that erase savings

- Incumbent dependency – Existing suppliers control proprietary specifications, molds, or intellectual property

- Supply chain disruption risks – Categories where supplier changes could impact production timelines or quality consistency

- Strategic supplier relationships – Suppliers who are also customers, joint venture partners, or have executive-level relationships

- Organizational resistance – Leadership or stakeholders unwilling to move away from certain suppliers for non-commercial reasons

Focus on Implementable Savings

Target categories where:

- Multiple qualified suppliers can deliver without major transition costs

- There are no lock-in mechanisms (contracts, tooling ownership, proprietary specs)

- Stakeholders are aligned and committed to awarding based on the auction outcome

- The supply chain can absorb a supplier change without disruption

Make Award Decisions Binding

Communicate clearly—internally and to suppliers—that the auction results will determine the award. This isn’t traditional supplier negotiation where outcomes are flexible. If suppliers sense you won’t actually switch, they won’t compete aggressively. If internal stakeholders know they can override the outcome, the entire process loses credibility.

Real savings happen when you can execute the award. Choose your auction categories accordingly.

Making It Happen

When you combine the right auction format with supplier trust, analytics-driven category selection, qualified supplier pools, and implementable awards, achieving 18–40% savings becomes realistic, repeatable, and scalable.

eSourcing is a methodology, not just a tool. Organizations that operationalize it well improve compliance, expand spend coverage, and unlock sustained year-on-year savings.

For teams looking to start or scale eSourcing, adopt an eSourcing platform that integrates RFx, spend analytics, auctions, and contract visibility in one workflow. This ensures maturity and measurable ROI.